Ethiopia Bond Coupon Miss to Make It Africa’s Latest Default

- Government says it’s unable to pay coupon due on Monday

- Ethiopia has 14-day grace period before it’s deemed in default

Ethiopia looks set to miss an interest payment due later on Monday on its December 2024 dollar bond, becoming the latest emerging-market sovereign to default on debt.

The country’s finance ministry said on Friday, it was “not in a position to pay” the $33 million coupon because of the nation’s “fragile external position.” It added that “restricted discussions” it had held with a group of bondholders had thus far been unsuccessful.

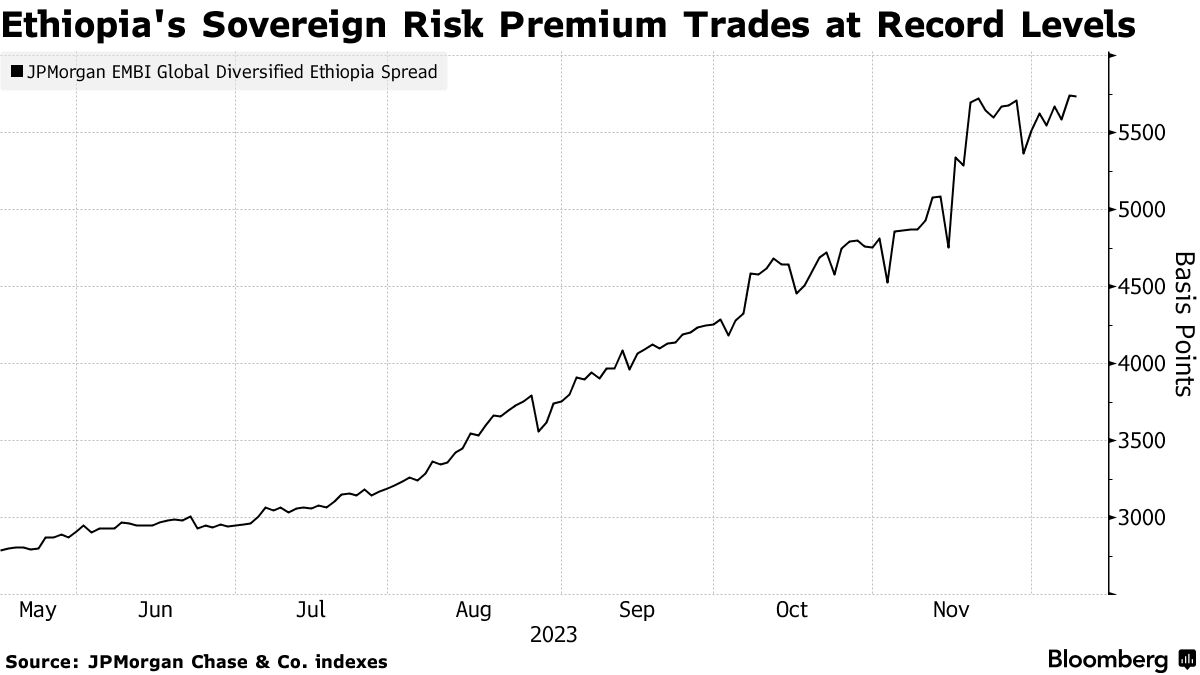

However, the Ethiopian government has proposed a restructuring that would avoid capital losses for bondholders in return for a lower coupon. That helped lift the price on the $1 billion Dec. 2024 eurobond by one cent to 62.8 cents by 10 a.m. in New York. The extra yield premium investors demand to own Ethiopian debt remains at 5,442 basis points over Treasuries, according to JPMorgan Chase & Co. data. Spreads of more than 1,000 basis points are viewed as distressed.

“Bonds are gaining, as initial terms proposed by government are basically in line with current market pricing and there is some hope of a better outcome post negotiations,” said Thys Louw, a portfolio manager with Ninety One UK Limited. He does not hold the bond.

The bond extended gains after EMTA, the emerging market trade association, issued a statement recommending that Ethiopia’s 2024 bonds entered into on or after Dec. 11 should trade “flat,” unless otherwise agreed. That means buyers of the security will receive the interest, whenever it is paid.

A default will put Ethiopia among the ranks of a growing number of developing nations that have defaulted on Eurobonds in recent years, including Zambia, Ghana and Sri Lanka. Tunisia, Pakistan and Bolivia are also seen at risk, bond market pricing implies.

The Horn of Africa nation still has a 14-day grace period before it’s deemed to be in default, according to the bond’s prospectus.

The government advised bondholders on Friday that significantly lower foreign-exchange reserves “inevitably impacts the Ministry of Finance’s ability to service imminent external borrowings.”

In its counterproposal for a restructuring, the government asked bondholders to extend the maturity to amortize from July 2028 through to Jan. 2032, and to reduce the coupon to 5.5% from the current 6.625%. However, the face value is to remain at $1 billion, meaning creditors won’t need to swallow a so-called haircut on their holdings.

That proposal implies a present value reduction of about 33% for the debt, using a 12% discount rate, according to Søren Mørch, portfolio manager at Danske Bank Asset Management, which holds the bond.

‘Unnecessary’ Default

An ad hoc committee of bondholders said it views the decision not to make the payment as “both unnecessary and unfortunate.”

Ethiopia is seeking to renegotiate its obligations through the Group of 20’s Common Framework, which has started to gain momentum after Zambia and Ghana made progress restructuring their debts. That allows debt relief from public as well as private lenders to be coordinated, to set debt treatment standards.

Ethiopia had already reached an in-principle agreement with bilateral creditors last month to suspend debt payments, having sought to rework its liabilities since 2021 as a civil war soured investor sentiment and sapped economic growth.

Now the clock is ticking to reach an emergency funding and economic program with the International Monetary Fund, which will lay out the parameters for a debt restructuring. Its Paris Club creditors set a deadline of March 31 to agree the program, or they could declare the debt-service suspension agreed last month null and void.

“It is difficult to move forward until there is an IMF program and a debt sustainability agreement. We should see an agreement around mid-next year at the earliest as a result,” said Kaan Nazli, a portfolio manager at Neuberger Berman Asset Management, which holds the Ethiopian bond.

The government will hold a call with global investors this week in which it plans to “set out a proposal it may launch related to the eurobond,” according to the ministry’s statement.

The ministry said Ethiopia’s government had proposed the following terms to bondholders during the recent restricted discussions:

- A four-year amortization period from July 2028 to Jan. 2032

- A coupon rate of 5.5%, of which 2.5% would be capitalized during the anticipated four-year IMF program period

- Bondholder committee “continues to remain open for constructive and proactive engagement with the Ethiopian authorities.”