The Middle Corridor: Reviving Connectivity for EU-Central Asia Trade and India’s Strategic Imperative

Author : Ayjaz Wani

The Middle Corridor: Reviving Connectivity for EU-Central Asia Trade and India’s Strategic Imperative

In the backdrop of the Russia-Ukraine war, this paper explores the changing dynamics of the European Union (EU)-Central Asia relationship. It emphasises the growing significance of the Middle Corridor—also known as Trans-Caspian International Transport Route connecting South East Asia with Europe—as a potential alternative route for both the EU and Central Asia, particularly in the context of compliance issues, with sanctions on Northern Route and escalating tensions in the Red Sea. Considering challenges such as regional instability, infrastructure limitations, and competition among global powers, the paper also examines the potential of the Middle Corridor in the context of India’s geostrategic and economic interests. The paper finds that the Middle Corridor could serve as a strategic alternative for diversifying trade and connectivity between the EU and Central Asia as well as for India, provided that stakeholders consider the evolving geopolitical landscape of Eurasia.

Ayjaz Wani, “The Middle Corridor: Reviving Connectivity for EU-Central Asia Trade and India’s Strategic Imperative,” Occasional Paper No. 449, September 2024, Observer Research Foundation.

Introduction

Escalating global geopolitical contestations compel the Central Asian republics and the European Union (EU) to reassess their strategic calculi. The Russia-Ukraine war has affected the geopolitical landscape, with ramifications extending to the EU and Central Asia. Traditionally dominated by Moscow both economically and politically, the Central Asian countries today view Russia as a threat to regional stability, sovereignty, and territorial integrity.[1] The harsher sanctions and disruptions as a result of the war have prevented European commodities from reaching Central Asia via Russia and cut the hydrocarbon-rich Central Asia’s direct access to European markets, thus prompting the EU to seek secure alternative transit routes to bypass Russia and the Northern Route.[2] The corresponding fallout from the Palestine-Israel conflict has led to increasing disquiet in the Red Sea, resulting in cargo rerouting, increased costs, longer transit times, and capacity shortages. These geopolitical contestations, geoeconomic challenges, and security dilemmas have caused the EU and Central Asia to reassess their foreign policy, particularly concerning strategic autonomy, sovereignty, safety, and stability in greater Eurasia. China’s increased economic and strategic presence in Russia’s backyard has further driven the EU and Central Asia to reassess their strategic relations.

Countries across Eurasia are exploring alternative and more resilient connectivity corridors to facilitate new trade routes and sustainable transport methods. The Middle Corridor, also known as the Trans-Caspian International Trade Route (TITR),[a] is a geostrategic and geoeconomic shift in the current vulnerable geopolitical environment and is crucial for enhancing connectivity between Asia and Europe.[3] The Middle Corridor also plays a pivotal role in the United States’ (US) and the EU’s adaptive and forward-thinking approaches to maintaining regional influence to counterbalance the China-Russia cooperative hegemony in Central Asia.

This paper examines the evolving dynamics of EU-Central Asia relations in the context of the ongoing Russia-Ukraine conflict and resulting disruptions. It highlights the growing importance of the Middle Corridor as a potential alternative trade route amidst sanctions on Russia and rising disquiet in the Red Sea. The paper also examines potential economic and broader trade opportunities for participating countries and evaluates related infrastructure limitations and capacity issues in the two regions. Finally, it explores how India can strategically leverage the Middle Corridor as a viable trade route to counter the persistent security concerns and political instability in the Red Sea.

EU-Central Asia Relations

After the fall of the Soviet Union, the EU adopted a modest Central Asia policy, with member states cautiously initiating diplomatic relations. The EU’s first Central Asia programme was the Technical Aid to the Commonwealth of Independent States (TACIS), during the 1991-2006 period.[4] However, much of the TACIS funding was directed at Ukraine and Russia instead of the Central Asian countries.[5] In 2005, the EU created the Special Representative post to increase its regional involvement. In 2007, it introduced the Central Asian Strategy, which emphasised improved strategic coordination and collaboration between the Central Asian countries and the European Commission.[6] The strategy viewed the vast energy resources of Central Asian countries as vital for Europe’s energy security.[7] The EU’s support for Central Asia between 2014 and 2020 amounted to US$1.2 billion, facilitating regional cooperation on trade, energy, climate, water, and socio-economic development.[8]

However, its focus on promoting democracy, upholding the rule of law, and protecting human rights also created unease among authoritarian regimes in Central Asia, which has led to EU struggling to gain allies and establish a presence in the region.[9] Consequently, the EU’s influence has remained constrained compared to that of Russia and China.

The growing Russia-China cooperative hegemony[10] in Central Asia and the Russia-Ukraine war have now forced the EU to reinvigorate its Central Asia policy. In 2019, the EU initiated the New Opportunities for a Stronger Partnership, focusing on comprehensive, sustainable, and rules-based connectivity to take on a new role in regional integration.[11] Central Asian countries also focused on their strategic autonomy in connectivity, trade, and security for an independent foreign policy.

After 2021, the EU and Central Asia have intensified high-level diplomatic visits to forge forward-looking relationships based on strategic autonomy in connectivity and trade. Since 2022, the number of high-level visits to the region by EU officials, including the High Representative, commissioners, and the Defence, Foreign, and Prime Ministers has increased. In October 2022, the President of the European Council, Charles Michel, attended a high-level meeting in Astana with the heads of state of Central Asian countries,[12] who stressed the importance of developing a regional vision and cooperation to develop sustainable connectivity between the EU and Central Asia, in line with the EU Global Gateway initiative.[13] In June 2023, the leaders held their second regional high-level meeting, where they reviewed EU-Central Asia cooperation.

The Middle Corridor and Trade Diversification

The Middle Corridor is a multimodal route initiated through a multilateral collaboration between Azerbaijan, Georgia, Kazakhstan, and Türkiye in 2013 to improve connectivity and East-West trade through Eurasia. The route starts in Southeast Asia and China and runs through Central Asia, the Caspian Sea, Azerbaijan, Georgia, and further to the EU. After the opening of the Trans-Kazakhstan railway line in 2014 and the completion of the modernised Baku–Tbilisi–Kars railway between Turkey and Azerbaijan via Georgia in 2017, the Middle Corridor became more accessible to reach China via the heart of Eurasia.[14] The route comprises approximately 4,250 km of rail lines and 500 km of seaway and links with Europe through Türkiye and the Black Sea.[15] Compared to the 10,000-km Northern Corridor, which takes 15-20 days to cover, and the 20,000-km sea route from East Asia to Europe via the Suez Canal, which takes 45-60 days,[16],[17] cargo transported through the Middle Corridor will only take 10-15 days to reach Europe from China’s north-western province of Xinjiang.[18]

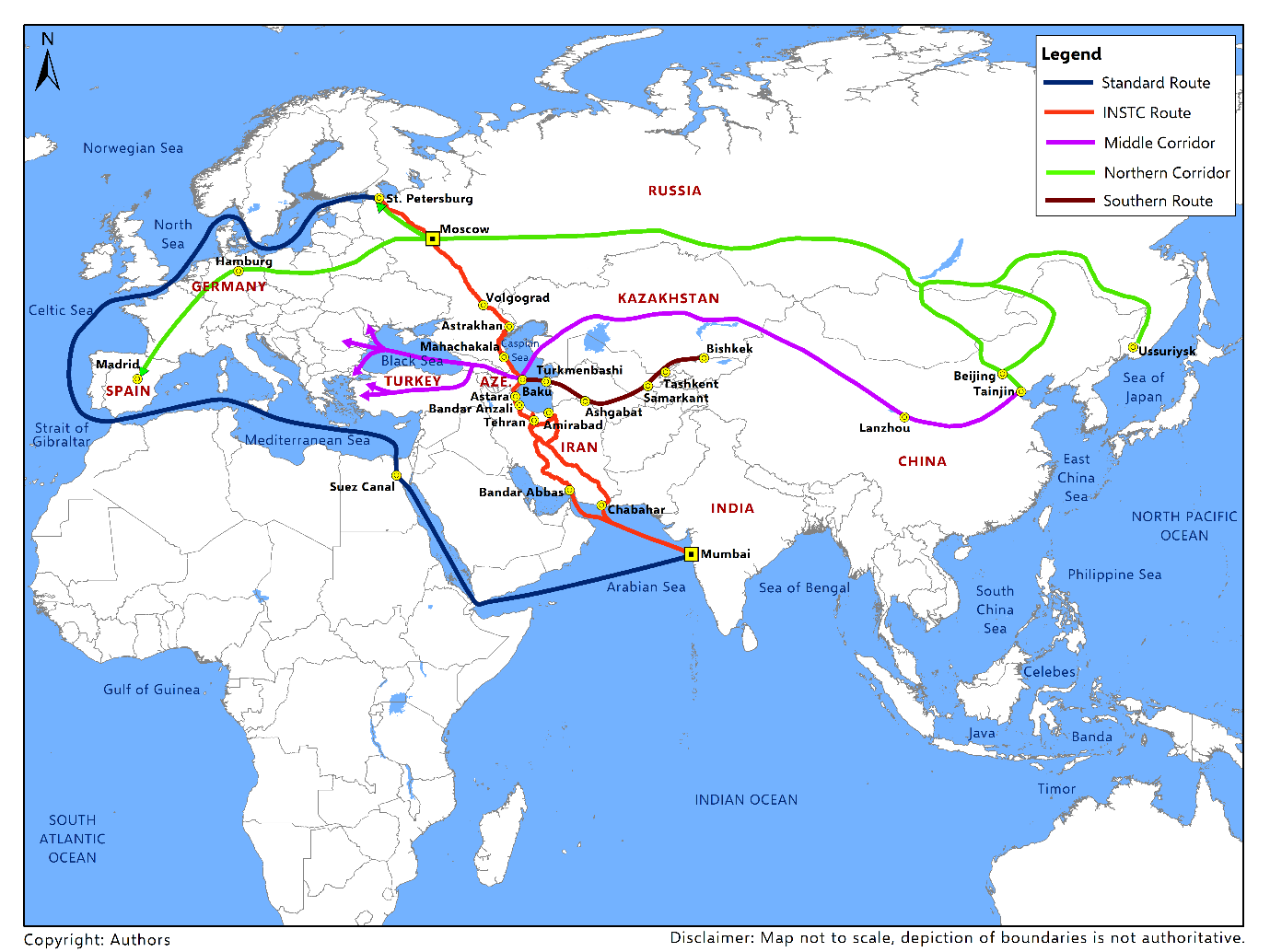

Map 1: INSTC, Middle Corridor, Northern Route, and Standard Route

Source: Author’s own

Between 2014 and 2021, 49,000 cargo trains traversed the Middle Corridor, at an annual increase of 92.7 percent. In 2021 alone, 15,183 container trains transported 1.464 million 20-foot equivalent units (TEUs) of cargo, recording increases of 22.4 percent and 29 percent, respectively, along the Middle Corridor.[19] Container traffic along the route in 2022 surged by 33 percent, with cargo traffic reaching 1.5 million tonnes and 33,000 TEUs.[20] In 2023, the transported cargo volume was around three million tonnes; in 2024, at least four million tonnes of cargo are projected to be transported via the Middle Corridor.[21]

Table 1: Transportation Volume via Middle Corridor in Thousand Tonnes

| Year | Volume |

| 2017 | 1,318 |

| 2018 | 1,020 |

| 2019 | 759 |

| 2020 | 784 |

| 2021 | 586 |

| 2022 | 1,485 |

| 2023 | 2,764 |

| till June 2024 | 1,647 |

Source: Middle Corridor[22]

At present, the Middle Corridor is served by 25 transport and logistics companies from 11 member countries, operating in vessels, ports, railways, and terminals.[23] The success of the Middle Corridor can be attributed to the joint efforts of countries such as Türkiye, Georgia, Azerbaijan, and Kazakhstan in developing railway lines, ports, and feeder shipping in the Caspian Sea. As the infrastructure along the route improves, intra-regional trade has increased within countries along the Corridor. Amid sanctions compliance issues along Russia’s Northern Corridor, the EU has renewed interest in the Middle Corridor. Sanctions against Russia have led cargo companies to abandon the Northern Corridor, resulting in a 51-percent decrease in westbound shipping volumes and a 44-percent decrease in eastbound shipping volumes in 2023.[24]

The Russia-Ukraine war has also highlighted the Corridor as a channel for increased diversification and economic resilience between the EU and Central Asia. The majority of cargo transportation on the Corridor occurs in the westward direction. Intra-regional trade between Central Asia and the Caucasus region and between Central Asia and Europe has dominated the route. In 2022, the goods transported towards the EU and Türkiye increased by 6.5 times compared to 2021, mainly from Central Asia. On the other hand, the route represented only 4 percent of the volume and 5 percent of the value of EU-China trade.[25] Table 2 shows the increase in trade between the EU and Central Asia after 2021.

Table 2: Trade Between the EU and Central Asia (in billion euros)

| Years | EU Imports | EU Exports |

| 2021 | 18.8 | 9.1 |

| 2022 | 31.4 | 16.1 |

| 2023 | 32.6 | 20.2 |

Source: The European Commission[26]

The EU mainly imports crude oil, metals, and gas, and exports machinery, equipment, cars, and other manufactured goods to Central Asia. In 2021, the EU accounted for 23.6 percent of the region’s foreign trade, and in 2023, the EU became Central Asia’s leading trading partner.[27]

Infrastructure Development and Regional Integration

The Middle Corridor currently has a capacity of around 5.8 million tonnes in both directions, which translates to some 80,000 containers.[28] The World Bank estimates cargo traffic to triple by 2030, with regional trade towards the EU dominating the Middle Corridor.[29] Nevertheless, the corridor requires investments in infrastructure upgrades and the integration of all Central Asian countries via railways and roads. The Central Asian countries have remained the least connected economies in the world despite China investing billions of dollars in the region through its Belt and Road Initiative (BRI). Beijing has prioritised its own geostrategic and geoeconomic interests in the area for the exploitation of hydrocarbon resources and to connect with the Northern Corridor of Russia.

Meanwhile, the EU has emphasised the importance of upgrading transport and connectivity infrastructure, first within the Central Asian countries and then to international markets and corridors. In 2024, the Global Gateway Investors Forum was held in Brussels to promote sustainable connectivity between the two regions. With support from the United States (US),[30] the EU and global financial institutions have pledged to invest US$10.8 billion to develop the Middle Corridor in Central Asia.[31] The EU’s investments in Central Asian countries show its commitment to improving connectivity between the two regions through the Global Gateway initiative.[b] The EU has also remained the region’s biggest investor, with over 40 percent of culminated investments.[32] Table 3 shows significant investments by the EU and other regional countries for regional integration and upgrading the Middle Corridor.

Table 3: Investments in the Middle Corridor After the Russia-Ukraine War

| Source of Investment | Size of Investment | Significance |

| Eurasian Development Bank (2024) | US$3.5 billion | Transportation infrastructure |

| European Commission (2022) | EUR 2.3 billion | Subsea electricity cable to transport electricity from Azerbaijan to the EU |

| European Bank for Reconstruction and Development (2024) | EUR 1.5 billion | Fund intraregional transport connectivity in Central Asia |

| European Investment Bank (2024) | EUR 1.47 billion | Sustainable transport projects across Central Asia |

| AD Ports and Kazakhstan National Oil Company (2022) | US$780 million | Provide shipping services for energy companies and the format for investment around the Caspian region Expand capacity to carry 8-10 million tonnes of crude annually |

| Semurg Invest (2023) | US$100 million | Increase the transport capacity of the Kuryk Port to 15-20 million tonnes per year |

| Azerbaijan (2022) | US$100 million | Funding for the Georgian side of the Baku-Tbilisi-Kars railway line for upgradation |

| Azerbaijan Railways CJSC (2023) | US$20.58 million | Modernisation of the railway network |

| Wondernet Express | US$20 million | Construct a fertiliser terminal at Georgia’s Batumi Port |

| Azerbaijan (2022) | US$100 million | Upgrade and modernisation of the Baku-Tbilisi-Kars rail line to increase its capacity fivefold to five million tonnes annually |

| Turkish Albayrak Group (2022) | US$20 million | Developed the Port of Baku Albayrak took over Ro-Ro container and fertiliser terminal operations |

| Kazakhstan’s Transport Ministry | US$618 million | Port of Aktau and Port of Kuryk Construction of a new fleet of transport ships, a new container hub, and improving port capacity |

Source: Author’s own

The EU’s Diversified Energy Resources

Until the third quarter of 2022, Russia was the EU’s primary oil supplier for decades, accounting for 25 percent of its hydrocarbons and serving as Germany’s largest energy supplier. In a strategic move to reduce reliance on Russia, the EU has actively sought to boost its imports of hydrocarbon energy from Central Asia. Kazakhstan has abundant gas resources (2.4 trillion cubic metres) and is ranked 12th in the world for oil reserves (with 30 billion barrels). Additionally, it holds the second largest uranium reserves, while Uzbekistan ranks fifth in uranium production.[33] Since 2021, Central Asia and the Caspian region have become essential for the EU to diversify its energy imports of oil and natural gas. In the first quarter of 2024, Kazakhstan became the third largest oil supplier to the EU, after the US and Norway.

Table 4: EU Imports of Petroleum Oil, by Partner Country (Q1 2024)

| Country | Percentage |

| United States | 17.1 |

| Norway | 13.6 |

| Kazakhstan | 10.9 |

| Nigeria | 7.9 |

| Libya | 7.2 |

| Saudi Arabia | 6.8 |

| Azerbaijan | 3.4 |

| Others | 33.0 |

Source: Eurostat database (Comext) and Eurostat estimates[34]

Kazakh oil is mainly exported through the Caspian Pipeline Consortium (CPC), and nearly two-thirds of the oil crosses Russia before reaching the market. Though using Russian infrastructure and pipelines is not subject to sanctions, it still exposes Moscow’s influence on Kazakh oil going to Europe. In 2022, the president of Kazakhstan stated that the country is prepared to utilise its hydrocarbon resources to help stabilise global and European markets. However, within two days, a Russian court issued an order to suspend CPC operations for 30 days due to concerns about oil-spill management.[35] Kazakhstan has attempted to transport oil via the Middle Corridor to Baku for further export to the EU through the Baku-Tbilisi-Ceyhan pipeline. This process involves multiple trans-shipment steps, resulting in significant delays and technical difficulties compared to CPC. Via the Middle Corridor, Kazakhstan aims to increase oil deliveries to 1.5 million tonnes, 1.4 times the amount in 2023.[36]

Similarly, in July 2022, the EU signed a deal to purchase gas from the Caspian Sea through the Southern Gas Corridor.[37] While the volume is insufficient to replace Russian gas supplies, the agreement is still considered strategic. In July 2022, Azerbaijan and the European Commission signed a deal to double natural gas exports to Europe by 2027. Turkmenistan’s gas was transferred to Azerbaijan through a swap agreement with Iran in 2021. Despite the US Ambassador to Turkmenistan saying a “swap through Iran does not violate sanctions,” Baku and Ashgabat could not reach an agreement on gas pricing for 2024, leading to the discontinuation of the arrangement.[38]

Table 5: EU’s Gas Imports (Q1 2024)

| Country | Percentage |

| Norway | 46.6 |

| Algeria | 19.7 |

| Russia | 17.3 |

| Azerbaijan | 7.7 |

| United Kingdom | 5 |

| Others | 3.6 |

Source: Eurostat database (Comext) and Eurostat estimates

Turkmenistan has the fourth largest gas reserves globally, with 13.4 trillion cubic metres and 20 billion tonnes of oil, which could be a viable option for the EU.[39] Energy cooperation between the EU and Turkmenistan is governed by a 2008 Memorandum of Understanding[40] that covers energy security, joint infrastructure projects, renewable energy initiatives, and efficiency enhancements.

For decades, Turkmenistan has considered exporting natural gas through the Trans-Caspian gas pipeline to Azerbaijan and Europe, but Russia and Iran have opposed such a project.[41] In 2023, Turkmenistan announced plans to connect its natural gas infrastructure to the South Caucasus and Europe through the proposed pipeline. In May 2024, Azerbaijan and Türkiye struck a deal to transfer natural gas from Turkmenistan.[42] Although Azerbaijan supports the export of gas from Turkmenistan to Europe and is ready to provide technical resources and access to the Sangachal terminal, it does not want to finance the pipeline.

Challenges to Growth of Middle Corridor

According to estimates, freight traffic along the Middle Corridor will triple by 2030. However, limited railway and seaport capacities, the absence of a unified tariff process, the lack of digitalisation, and the shortage of shipping containers in the Caspian Sea are creating bottlenecks along the route. Central Asian countries also require investments to develop railways for regional integration and connect the Middle Corridor. The investments needed for infrastructure upgrades along the route are estimated at around US$20.5 billion in 2023.[43]

The Middle Corridor, despite its challenges, is a competitive option for cargo transportation. The potential to reduce the cost of shipments and transit time makes it a more attractive route than the Northern Corridor of Russia and the sea route through the Suez Canal. In 2020, the transportation cost per 40-foot container from China to Europe through the Russian Northern Corridor was between US$2,800 and US$3,200, for the Maritime route was between US$1,500 and US$2,000, and for the Middle Corridor remained between US$3,500 and US$4,500. Despite these costs, the Middle Corridor’s potential to reduce transit time and offer a more direct route offers a clear advantage for stakeholders.[44]

In 2022, Türkiye, Georgia, Azerbaijan, and Kazakhstan signed a roadmap to improve the efficiency of a route by eliminating bottlenecks. In 2023, Kazakhstan, Georgia, and Azerbaijan formed a trilateral to establish a jointly run and owned logistics company to reduce operational delays and streamline the tariff process along the route. They took measures for quick transportation and capacity of the Georgian section of the Baku–Tbilisi–Kars line, which was increased to five million tonnes, and the upgrade was completed in May 2024. These measures led to a reduction in transit time to 19-23 days by the end of 2023.[45]

Azerbaijan has already increased its capacity with the modernisation of Baku port, which is well connected to the national railway lines and has provisions in place for dispute mitigation in accordance with international laws. The port’s capacity is being expanded to include two more loading berths, which will handle 25 million tonnes of freight and one million TEUs. Additionally, Baku has the largest civilian fleet in the Caspian Sea, with 52 cargo ships, and the Baku Shipyard can manufacture all types of vessels. Kazakhstan has also signed a deal with the UAE-based AD Ports Group to provide shipping services for energy companies operating in the Caspian Sea under the joint venture.[46] Under this deal, the container feeders for crude oil transportation in the Caspian and Black Seas will increase to provide sub-sea solutions.

In 2023, Kazakhstan and Uzbekistan began the construction of a 152-km railway line between Darbaza and Maktaaral to help cargo movement between the two countries. Kazakhstan has also started on a new railroad bypassing Almaty; by 2026, over 1,300 km of new railroads are aimed to be built for smooth cargo movement along the Middle Corridor.[47] Uzbekistan, a double-landlocked country, conducts 80 percent of its trade through Russian territory via the Northern Corridor. The war in Ukraine has forced Tashkent to search for new trade routes, and a diversion towards the Middle Corridor needs more investments and infrastructure projects.

Regional Instability

The countries involved in the Middle Corridor are being impacted by intra-regional disputes, boundary demarcation issues, and political instability. There are border disagreements and territorial disputes between Uzbekistan and Kyrgyzstan, Uzbekistan and Tajikistan, and Kyrgyzstan and Tajikistan. These conflicts have had negative consequences on regional cooperation and integration and have led to skirmishes. Although the three countries have made strides in demarcating their borders and resolving competing claims, these issues require permanent solutions for economic and regional integration.

The relationship between Azerbaijan and Armenia has been strained since 1991, which intensified during the Nagorno-Karabakh conflict in 2023, in which thousands of ethnic Armenians fled to Armenia. In 2020, several thousands were killed in six weeks of fighting. Both countries are attempting to negotiate a peace treaty, but there is no clarity on issues such as enclaves, delimitation of borders, and transport links. Yerevan wants to use military maps from the 1970s, whereas Baku prefers to map the situation on the ground for the permanent settlement of border disputes; in such a process, it stands to retain many strategic positions.[48]

In May 2024, Yerevan returned four border villages to Baku as part of efforts to secure peace. On the sidelines of the NATO Summit in July 2024, the Foreign Ministers of Armenia and Azerbaijan met with US Secretary of State Antony Blinken in Washington, highlighting the growing US involvement in Eurasia and the importance of the Middle Corridor. [49] The trilateral meeting was part of US efforts to avert further conflict between the two countries. If Armenia and Azerbaijan can normalise relations through a peace agreement, it will open new regional opportunities for connectivity.

Competition and the Influence of Global Powers

Geopolitical and strategic competition between the powers in the region poses obstacles to regional integration, peace, and the growth of the Middle Corridor as a trade route. The growing competition between the US and China on the global stage and the strengthening alliance between Moscow and Beijing on issues in Central Asia, among others, have intensified geopolitical tensions. In 2015, the US and five Central Asian countries initiated the consultative C5+1 format at the Foreign Ministers level to discuss and strengthen relations in security, infrastructure modernisation, connectivity, and strengthening the rule of law.[c],[50]

The Caucasus Region

Beijing’s attempt to develop the freight corridor in the Caucasus region as part of the BRI has yet to yield results. Despite efforts to integrate the BRI with the Middle Corridor, China has yet to make any substantial investments in developing this corridor. The Middle Corridor is shorter and strategic for the multi-vector foreign policy of Central Asian countries, which will take the region out of the cooperative hegemony of China and Russia. The route could potentially undermine the competitiveness of existing routes through Russia, thus straining Beijing’s relationship with Moscow. Some countries have also expressed concerns about collaborating with China on projects, pointing to the limited success of the China-Pakistan Economic Corridor (CPEC), and are wary of China’s motivations.

Growing trade between countries along the route and between Central Asia and the EU surged after the Russia-Ukraine war. Consequently, Beijing is attempting to align the BRI and the Middle Corridor in the Caucasus countries of Azerbaijan and Georgia to decrease China’s reliance on existing routes and reduce the risk of disruptions.[51] Following the visit of the Georgian Prime Minister to China in 2023, relations between the two nations were upgraded to a strategic partnership prioritising bilateral ties. Both countries stressed increased cooperation in transportation, infrastructure modernisation, and the development and strengthening of the Middle Corridor.[52] Beijing was interested in the Black Sea region and increased its involvement in the Corridor. In May 2024, Georgia announced that China would construct a deep-sea port in Anaklia on the Black Sea.[53] Georgia also endorsed the Global Security Initiative of China for broader political alignment and collaboration in regional and international affairs.[54] These developments came at a time when BRI was becoming more controversial in the EU, especially after Italy’s departure.

Tbilisi has also found itself in a difficult position after the start of the Ukraine war. Since the invasion of 2008, Russia has occupied two territories of Georgia. The fear of renewed military moves from Moscow has pushed Georgia towards renewed rapprochement towards Russia, and Tbilisi has toned down its EU and NATO membership aspirations.[55] Tbilisi has abstained from anti-Russian sanctions and introduced a new law that will brand West-backed non-government organisations (NGOs) and media outlets as “foreign agents”.[56] In July 2024, Georgia’s growing relations with Beijing and increased anti-West rhetoric led to the EU to stop Georgia’s accession process to the Union.

The Middle Corridor’s economic and strategic significance could help the US and the EU mitigate global competition with Beijing and Moscow in strategically important Eurasia. The US has also pushed for “continued investment in and development of” the Middle Corridor and pledged to use the G7 Partnership for Global Infrastructure and Investment (PGI) to further critical transport, clean energy, critical minerals supply chains, and digital connectivity.[d],[57]

Central Asia

Central Asian countries have traditionally relied on Russia for security, but events in Ukraine have prompted them to seek new security and economic partners as well as new connectivity routes. Moscow has a strong presence in the region through the Eurasian Economic Union and Collective Security Treaty Organisation (CSTO). Except for Turkmenistan, the other Central Asian countries are considered “Putin’s pals”,[58] and Russia dominates the region economically. The remittances of labour migrants to Russia from Tajikistan, Kyrgyzstan, and Uzbekistan constitute 32.1 percent, 31.3 percent, and 18 percent of gross domestic production (GDP), respectively. Moscow’s principal aim has been to control regional energy politics to maintain a monopoly over EU supplies, preventing the Union from gaining access to Central Asia and its markets. Yet, in the post-Soviet era, it was forced to create a division of influence with Beijing over the region through cooperative hegemony.[59]

Beijing has since invested heavily in pipelines and the region’s oil and gas sector. In 2021, Turkmenistan supplied China with 34 billion cubic metres of natural gas. Currently, China imports 30 percent of its natural gas through pipelines connecting Beijing and Shanghai with Central Asia, most of which comes from Turkmenistan.[60] China also formed the Shanghai Cooperation Organisation (SCO) in 2001 to solidify its hard power in the region. Between 2003 and 2020, China held 45 joint military drills with the Central Asian countries within the framework of the SCO on a bilateral or trilateral basis. Beijing also established programmes to train the armies of Central Asian countries and provided military technology assistance. Following the easing of COVID-19-related restrictions in 2022, Uzbekistan and Kazakhstan were the first countries that Chinese President Xi Jinping visited.[61]

The geoeconomic and geostrategic engagement and growing heft over Central Asia have left the EU and the US with limited options. However, Russia’s focus on Ukraine, and China’s economic slowdown, have created an opportunity for the US to begin engaging at the highest level with Central Asia through meetings and visits, including one by the Secretary of State in 2023 and a meeting between President Biden and Central Asian leaders in Washington in 2023. Russia and China have increased their diplomatic visits and regional engagements to counter the EU and the US.

Given the geography of the Caucasus and Central Asian countries and the increasing competition among major players, the success of the Middle Corridor depends on the ability of regional actors such as Kazakhstan, Uzbekistan, and Azerbaijan to cooperate and prioritise economic development over geopolitical competition and disputes. The competition between the US and China for influence in the Caucasus region creates uncertainty, particularly with Georgia’s recent shift towards Beijing. The Central Asian countries are navigating growing competition among global powers as they work to secure their sovereignty and establish new economic corridors while aiming to remain neutral and avoid becoming pawns in the competition. They are also aiming to prevent any player from establishing dominance over the region. A stable and prosperous Central Asia with a well-developed Middle Corridor benefits all stakeholders and gives the region renewed geostrategic significance.

India’s Strategic Imperative

India is currently the world’s fastest developing economy and is on track to becoming a US$5-trillion economy within the next two years. New Delhi must develop resilient, reliable, diversified supply chains to sustain its growth and establish India as a global manufacturing hub by 2030. Due to international geopolitical conflicts and growing concerns in the Red Sea, New Delhi renewed its policy to secure access and transit rights across Eurasia to support its economic growth. India’s Central Asia policy received a much-needed boost through the signing of a ten-year agreement in 2024 for the development and operations of Chabahar Port with Iran, which aims to establish resilient connectivity with Eurasia, especially Central Asia.[62] Under the agreement, New Delhi will invest US$120 million and a US$250-million credit line to improve Chabahar-related infrastructure.[63]

However, China’s influence in Eurasia and the hostility between India and Pakistan have impeded India’s attempts to establish direct connectivity for strong trade and economic relations with the region. The Chabahar Port is a critical maritime nod to India’s connectivity projects, such as the International North-South Transport Corridor (INSTC) with Eurasia. The INSTC, a 7,200-km long multimodal network, will reduce transit time by 40 percent and lower freight costs by 30 percent compared to the Suez Canal route.[64] In July 2022, the INSTC recorded its first shipment from Russia’s Astrakhan Port to India’s Jawaharlal Nehru Port. In 2023, 19 million tonnes of cargo were transported along the eastern and western routes of the INSTC, compared to 14 million tonnes in 2022.[65] Though the share of freight traffic in containers on the western route of the INSTC increased by 9 percent in 2023, up from 4.1 percent in 2022, it is still notably lower than other Eurasian Transport Network transport corridors.[66]

Nonetheless, container traffic will increase after completing the 628 km-long Chabahar-Zahedan railway line and the 164-km Rasht-Astara railway line. The construction of the Rasht-Astara railway line on the western corridor of the INSTC has gained momentum due to a US$1.4-billion interstate loan from Russia to Iran and is scheduled to be completed by 2028. Additionally, a 37-km rail section from Rasht to the Anzali port of Iran in the Caspian Sea was inaugurated in June 2024; the rail line connects the Caspian Sea to the Persian Gulf via Iran’s existing rail networks.[67]

India’s trade with the Caspian region and Central Asia was valued at US$4.5 billion in 2023 and could increase threefold after the completion of the INSTC. Connecting Chabahar Port with the western and eastern routes of the INSTC can increase trade between India and Eurasia to US$200 billion. Central Asian countries recognise the Chabahar and INSTC projects as game-changers that can lessen their reliance on China and Russia to mitigate geopolitical threats. In 2020, Uzbekistan initiated a trilateral working group with Iran and India on the Chabahar Port to achieve seamless connectivity and trade convergence. In 2023, India and Central Asian countries formed a joint working group on Chabahar to boost private sector participation.

The US considers the Chabahar Port to be a strategic balance to China’s BRI. In 2018, New Delhi obtained exemptions from the US for the Chabahar and other infrastructure projects. Subsequently, Beijing’s security and economic concerns have increased in the China-Pakistan Economic Corridor, a flagship BRI programme with US$62 billion worth of investments. Attacks on Chinese workers have increased, even as the Gwadar Port in Baluchistan performs worse than other ports.[e] The growing anti-China protests in Baluchistan have also acted as speed-breakers to China’s secure access to the Arabian Sea for trade and energy supply via the Gwadar Port. The CPEC’s development has been hindered by Pakistan’s political, economic, and security instability, which has led to China turning to Iran and its ports.

In 2021, China and Iran signed a “strategic cooperation pact”, and in 2023, the countries signed 20 agreements worth billions of dollars in trade, transportation, and information technology, including the high-speed rail connecting Tehran with Mashhad. Between 2018 and 2022, Beijing invested US$618 million in infrastructure projects in Iran.[68] China also initiated cargo train services with Iran through Kazakhstan and Turkmenistan in July; the train reached Iran in 10 days via the Inche-Burun checkpoint on the Turkmenistan-Iran border.[69]

India-led connectivity projects are progressing slowly and steadily, and the Middle Corridor can provide access to new markets and diversified supply chains. India should actively engage with stakeholders of the Middle Corridor to secure its economic interests and establish itself as a key player in Eurasia’s evolving geopolitical landscape. India can also expand its trade ties with Europe via the INSTC and Chabahar.

Given growing geopolitical contestations, the US could view India’s investments in Chabahar and beyond as strategic and provide more tactical support to New Delhi to develop and strengthen cooperation in these projects with Central Asian countries. The US seeks to weaken Chinese transportation projects like BRI in Eurasia by endorsing the Middle Corridor and even supporting the Turkmen gas swaps with Iran for EU energy security via the Southern Gas Corridor. Rather than Iran’s economic gains, supporting New Delhi’s connectivity initiatives with the EU, Central Asia, and the Caucasus through Chabahar and the INSTC should be a strategic priority for the US and India. To counter growing Chinese influence in the region economically and strategically, the US, EU, and India can establish a coherent rather than divergent policy towards Eurasia.

Conclusion

The Middle Corridor is becoming a strategic alternative amid the Russia-Ukraine war and escalating tensions in the Red Sea. The Corridor provides opportunities for the EU, Central Asia, the Caspian region, and India to diversify trade and connectivity. Despite infrastructure limitations, regional instability, and growing competition among global powers, the Middle Corridor provides promising avenues for enhanced economic cooperation and geopolitical influence.

EU’s commitment to infrastructure development under the Global Gateway initiative will accelerate the growth of the Middle Corridor, foster regional integration, and strengthen economic relations. India can leverage its solid historical socioeconomic and cultural ties and geographical proximity with Eurasia to create synergy between INSTC and the Middle Corridor for reliable and resilient connectivity with Central Asia, the Caspian region, and Europe.

Successfully implementing the Middle Corridor requires concerted efforts from all stakeholders to address the challenges and capitalise on the opportunities. Regional cooperation, infrastructure development, and a stable regional geopolitical environment are essential for the long-term success of this vital trade route.

Endnotes

[a] It is an alternative route to the Northern Corridor through Russia and the Ocean Route of the Suez Canal. Operational since 2017, the Middle Corridor is the shortest and fastest transit route between East Asia and Europe via the heart of Eurasia. See: https://eabr.org/en/analytics/special-reports/the-eurasian-transport-network/

[b] With around US$450 billion allocated between 2021 and 2027, the Global Gateway initiative represents a strategic effort to enhance transnational sustainable connectivity and infrastructure. See: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/stronger-europe-world/global-gateway_en

[c] The C5+1 format is viewed as an attempt by the US to gain influence in Central Asia, countering both China and Russia. In 2022, C5+1 launched a secretariat to advance shared priorities, coordinate communications between the participating countries, and plan the highest-level engagements. See: https://www.state.gov/c51-diplomatic-platform/#:~:text=The%20C5%2B1%20diplomatic%20platform,%2C%20Turkmenistan%2C%20and%20Uzbekistan

On 19 September 2023, under the C5+1 format, Presidents of Central Asian countries had a first-ever summit with US President Joe Biden on the sidelines of the 78th session of the UN General Assembly. Biden pressed for “Continued investment in and development of the Trans-Caspian Trade Route, or the so-called Middle Corridor”. See: https://www.whitehouse.gov/briefing-room/statements-releases/2023/09/21/c51-leaders-joint-statement/?_gl=1*1eihfd8*_gcl_au*MjAzNjU5OTU5Ni4xNzAyMTkyNzkx

The US President also pledged to use the G7 Partnership for Global Infrastructure and Investment (PGI) to promote Investments and assist in developing the Middle Corridor. The PGI will evaluate opportunities to scale infrastructure investments to accelerate economic development, energy security, and connectivity of the Middle Corridor to further C5+1 economic goals.

[d] The US-led PGI initiative started in 2022 and is seen as a counter to the Chinese multi-trillion-dollar BRI for building connectivity and infrastructure in Asia, Europe, Latin America, and Africa. The White House described the PGII as a “values-driven, high-impact, and transparent infrastructure partnership to meet the enormous infrastructure needs”. See: https://www.state.gov/about-us-office-of-the-u-s-special-coordinator-for-the-partnership-for-global-infrastructure-and-investment/

[e] Since its completion in 2017, the highest number of ships that the port has logged in a year is 22. It has also failed to attract any deep-sea shipping lanes. See: https://www.dw.com/en/pakistans-gwadar-port-shows-chinas-belt-and-road-can-fail/a-68992914

[1] Ayjaz Wani, “Amid Russia-Ukraine Conflict, Advantage China in Central Asia,” Observer Research Foundation, November 23, 2023, https://www.orfonline.org/research/amid-russia-ukraine-conflict-advantage-china-in-central-asia

[2] Amparo Martí, Vitaliy Stepanyuk and Camino King, Central Asian Pawns; Game of influences in Stan Region, Center for Global Affairs & Strategic Studies University of Navarra, 2022, https://www.unav.edu/documents/16800098/17755721/CA_SAR_2022-Dic_VStepanyuk-CKing-AMarti.pdf#:~:text=Russian%20War.%20Sanctions%20on%20Russia%20have%20prevented%20European,in%20the%20West%2C%20arresting%20their%20progress%20towards%20post-pande

[3] S. Amangeldy et al., The Eurasian Transport Network, Almaty, Eurasian Development Bank, 2024, https://eabr.org/en/analytics/special-reports/the-eurasian-transport-network/

[4] European Union, European Court of Auditors, Luxembourg, EU Development Assistance To Central Asia, 2013, https://www.eca.europa.eu/Lists/ECADocuments/SR13_13/QJAB13014ENN.pdf

[5] Patrick Holden, In Search of Structural Power: EU Aid Policy As a Global Political Instrument, (London: Routledge, 2009), https://doi.org/10.4324/9781315588148.

[6] Martin Russell, The EU’s New Central Asia strategy, European Parliamentary Research Service, 2019, https://www.europarl.europa.eu/RegData/etudes/BRIE/2019/633162/EPRS_BRI(2019)633162_EN.pdf

[7] Neil Melvin and Jos Boonstra, The EU Strategy for Central Asia after One Year, Europe-Central Asia Monitoring, 2008, https://eucentralasia.eu/the-eu-strategy-for-central-asia-one-year/

[8] European Union External Action, “EU Development Priorities in Central Asia,” March 16, 2022, https://www.eeas.europa.eu/eeas/eu-development-priorities-central-asia_en

[9] Catherine Putz, “Weeks After Russia-Central Asia Leaders’ Meeting, Europe Comes Calling Too,” The Diplomat, October 31, 2022, https://thediplomat.com/2022/10/weeks-after-russia-central-asia-leaders-meeting-europe-comes-calling-too/

[10] Kira Schacht, “Pakistan’s Gwadar Port Shows China’s Belt and Road Can Fail,” DW, May 13, 2024, https://www.dw.com/en/pakistans-gwadar-port-shows-chinas-belt-and-road-can-fail/a-68992914

[11] European Council, Council of the European Union, https://www.consilium.europa.eu/en/press/press-releases/2019/06/17/central-asia-council-adopts-a-new-eu-strategy-for-the-region/

[12] European Council, Council of the European Union, https://www.consilium.europa.eu/en/european-council/president/news/2022/10/28/20221028-pec-visits-central-asia/

[13] European Council, Council of the European Union, https://www.consilium.europa.eu/en/press/press-releases/2022/10/27/joint-press-communique-heads-of-state-of-central-asia-and-the-president-of-the-european-council/

[14] Li Yan, “Turkey’s First China-bound Exports Cargo Train Crosses Border,” Ecns.cn, December 12, 2018, https://www.ecns.cn/business/2020-12-18/detail-ihaexsqc6149869.shtml

[15] Nigar Jafarova, “The Rise of Middle Corridor,” Frontierview, May 25, 2023, https://frontierview.com/insights/the-rise-of-the-middle-corridor/

[16] Mirek Dušek, “Why should Europe/China trade Use the Middle Corridor route?,” The World Economic Forum, 2023, https://www.weforum.org/agenda/2023/06/creating-a-green-and-digital-corridor-through-eurasia/

[17] Dušek, “Why should Europe/China trade use the Middle Corridor route?”

[18] European Commission, “Global Gateway: EU and Central Asian Countries Agree on Building Blocks to Develop the Trans-Caspian Transport Corridor,” 2024, https://international-partnerships.ec.europa.eu/news-and-events/news/global-gateway-eu-and-central-asian-countries-agree-building-blocks-develop-trans-caspian-transport-2024-01-30_en

[19] World Bank, Middle Trade and Transport Corridor: Policies and Investments to Triple Freight Volumes and Halve Travel Time By 2030, November 2023, Washington DC, World Bank Group, 2023, https://www.worldbank.org/en/region/eca/publication/middle-trade-and-transport-corridor

[20] Assel Satubaldina, “Cargo Transportation Along Middle Corridor Soars 88%, Reaches 2 Million Tons in 2023,” The Astana Times, December 28, 2023, https://astanatimes.com/2023/12/cargo-transportation-along-middle-corridor-soars-88-reaches-2-million-tons-in-2023/

[21] Tapdıq Fərhadoğlu, “Cargo Transportation Through the Middle Corridor Continues to Grow,” VOA, July 8, 2024, https://www.amerikaninsesi.org/a/7689024.html

[22] Middle Corridor, “Trans-Caspian International Transport Route,” https://middlecorridor.com/en/

[23] Wani, “Amid Russia-Ukraine Conflict, Advantage China in Central Asia”

[24] Ganyi, Zhang, and Ariel F. Dumont, “Contrasting Rail Freight Trends Between China and Europe,” Market Insights, 2023, https://market-insights.upply.com/en/contrasting-rail-freight-trends-between-china-and-europe

[25] “Middle Trade and Transport Corridor: Policies and Investments to Triple Freight Volumes and Halve Travel Time By 2030, November 2023”

[26] European Commission, “EU Trade Relations With Central Asia,” 2024, https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/central-asia_en

[27] European Commission, “EU Trade Relations with Central Asia”

[28] “The Eurasian Transport Network”

[29] “Middle Trade and Transport Corridor: Policies and Investments to Triple Freight Volumes and Halve Travel Time by 2030, November 2023”

[30] The White House, “C5+1 Leaders’ Joint Statement,” September 21, 2023, https://www.whitehouse.gov/briefing-room/statements-releases/2023/09/21/c51-leaders-joint-statement/?_gl=1*1eihfd8*_gcl_au*MjAzNjU5OTU5Ni4xNzAyMTkyNzkx

[31] Toghrul Ali, “European and International Financial Institutions to Invest $10 Billion in the Middle Corridor,” Caspian Policy Center (CPC), February 1, 2024, https://www.caspianpolicy.org/research/economy/european-and-international-financial-institutions-to-invest-10-billion-in-the-middle-corridor

[32] European Commission, “EU Trade Relations with Central Asia. Facts, Figures and Latest Developments,” https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/central-asia_en

[33] Yang Jiang, “China Leading the Race for Influence in Central Asia,” Danish Institute for Internationale Studies (DIIS), October 10, 2022, https://www.diis.dk/en/research/china-leading-the-race-influence-in-central-asia

[34] Eurostat, “EU Imports of Energy Products — latest developments,” July 1, 2024, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_imports_of_energy_products_recent_developments&oldid=554503#Main_suppliers_of_petroleum_oils.2C_natural_gas_and_coal_to_the_EU

[35] Carole Nakhale, “Kazakhstan May Improve the EU Energy Security,” GIS Reports, June 2, 2023, https://www.gisreportsonline.com/r/eu-energy-security/

[36] Almaz Kumenov, “Kazakhstan Plans to Increase Oil Exports Amid Falling Revenues,” Eurasianet, March 8, 2024, https://eurasianet.org/kazakhstan-plans-to-increase-oil-exports-amid-falling-revenues

[37] David O’Byrne, “Azerbaijan’s Russian Gas Deal Raises Uncomfortable Questions for Europe,” Eurasianet, November 22, 2022, https://eurasianet.org/azerbaijans-russian-gas-deal-raises-uncomfortable-questions-for-europe

[38] Vasif Huseynov, “Uncertainty Abounds in Talks on the Possible Export of Turkmen Gas to Europe,” The Jamestown Foundation, June 5, 2024, https://jamestown.org/program/uncertainty-abounds-in-talks-on-the-possible-export-of-turkmen-gas-to-europe/

[39] Martha Brill Olcott, “Turkmenistan: Real Energy Giant or Eternal Potential?,” Carnegie, December 10, 2013, https://carnegieendowment.org/posts/2013/12/turkmenistan-real-energy-giant-or-eternal-potential?lang=en¢er=middle-east

[40] European Commission “The EU and Turkmenistan Strengthen Their Energy Relations With a Memorandum of Understanding,” May 28, 2008, https://ec.europa.eu/commission/presscorner/detail/en/IP_08_799

[41] Stefan Hedlund, “Turkmenistan’s Bid to Link Up With Gas-hungry Europe,” GIS Reports, January 15, 2024, https://www.gisreportsonline.com/r/turkmenistan-europe-gas/

[42] Samantha Fanger, “ Azerbaijan and Türkiye Solidify Key Energy Alliance with Turkmen Gas Deal,” Caspian Policy Center (CPC), June 13, 2024, https://www.caspianpolicy.org/research/energy/azerbaijan-and-turkiye-solidify-key-energy-alliance-with-turkmen-gas-deal

[43] European Commission, “Sustainable Transport Connections Between Europe and Central Asia,” European Bank for Reconstruction and Development (EBRD), June 30, 2023, https://www.ebrd.com/news/publications/special-reports/sustainable-transport-connections-between-europe-and-central-asia.html

[44] OECD, “Realising the Potential of the Middle Corridor,” https://beta.oecd.org/content/dam/oecd/en/publications/reports/2023/12/realising-the-potential-of-the-middle-corridor_c458041c/635ad854-en.pdf

[45] “The Eurasian Transport Network”

[46] “AD Ports, Kazmortransflot in Caspian Sea Offshore Services JV,” Offshore Engineer Magazine, December 28, 2022, https://www.oedigital.com/news/501841-ad-ports-kazmortransflot-in-caspian-sea-offshore-services-jv

[47] Official Information Source of the Prime Minister of the Republic of Kazakhstan, “Landmark Megaproject: Kazakhstan and Uzbekistan to Be Connected Via New Railroad,” November 27, 2023, https://primeminister.kz/en/news/landmark-megaproject-kazakhstan-and-uzbekistan-to-be-connected-via-new-railroad-26408 .

[48] Kirill Krivosheev, “Landmark Armenia-Azerbaijan Peace Treaty Inches Closer” Carnegie Endowment for International Peace, January 23, 2024, https://carnegieendowment.org/russia-eurasia/politika/2024/01/landmark-armenia-azerbaijan-peace-treaty-inches-closer?lang=en

[49] Agence France-Presse, “Armenia, Azerbaijan to Hold U.S.-Mediated Peace Talks,” The Hindu, July 10, 2024, https://www.thehindu.com/news/international/armenia-azerbaijan-hold-us-mediated-peace-talks/article68390307.ece

[50] The White House, “C5+1 Leaders’ Joint Statement”

[51] Fred Dews, “China’s Energy Vulnerabilities, ”Brookings Institution, April 17, 2014, https://www.brookings.edu/articles/map-chinas-energy-vulnerabilities/

[52] Embassy of the People’s Republic of China in Georgia, “Joint Statement of the People’s Republic of China and Georgia on Establishing a Strategic Partnership,” August 7, 2023, http://ge.china-embassy.gov.cn/eng/xwdt/202308/t20230807_11123383.htm#:~:text=The%20two%20sides%20have%20signed,strengths%20and%20opportunities%20of%20cooperation

[53] Jozwiak, Rikard and Reid Standish, “Chinese-Led Consortium To Build Massive Port Project On Georgia’s Black Sea Coast,” Radio Free Europe Radio Liberty, May 29, 2024, https://www.rferl.org/a/anaklia-georgia-china-port-winner/32970697.html

[54] Miro Popkhadze, “China Continues to Deepen its Political Influence in Georgia,” Foreign Policy Research Institute, September 13, 2023, https://www.fpri.org/article/2023/09/china-continues-to-deepen-political-influence-in-georgia/

[55] Vladimir Solovyov, “What’s Behind Russia’s Overture to Georgia?,” Carnegie Endowment for International Peace, May 17, 2023, https://carnegieendowment.org/russia-eurasia/politika/2023/05/whats-behind-russias-overture-to-georgia?lang=en

[56] Gabriel Gavin, “EU Announces Georgia’s Accession is ‘Stopped’ After Anti-West Pivot,” POLITICO.eu, July 9, 2024, https://www.politico.eu/article/georgia-eu-accession-stopped-anti-west-pivot-russian-law-foreign-agent-bill/

[57] The White House, “C5+1 Leaders’ Joint Statement”

[58] Bruce Pannier, “Central Asia in Focus: Russian Ties,” Radio Free Europe RadioLiberty, March 21, 2023, https://about.rferl.org/article/central-asia-in-focus-russian-ties/

[59] Wani, “Amid Russia-Ukraine Conflict, Advantage China in Central Asia”

[60] Wani, “Amid Russia-Ukraine Conflict, Advantage China in Central Asia”

[61] Amy Gunia, “Xi Jinping’s Choice of Kazakhstan for His First Overseas Trip Since the Pandemic Is Highly Significant,” TIME, September 14, 2022, https://time.com/6212887/xi-jinping-kazakhstan-china-trip/

[62] Dinakar Peri and Suhasini Haidar, “India, Iran Sign 10-year Contract for Chabahar Port Operation,” The Hindu, May 13, 2024, https://www.thehindu.com/news/national/india-iran-sign-long-term-bilateral-contract-on-chabahar-port-operation/article68171624.ece

[63] Peri and Haidar, “India, Iran Sign 10-year Contract for Chabahar Port Operation”

[64] Ayjaz Wani, “The Middle Corridor and Opportunities for India”, Observer Research Foundation, January 15, 2024, https://www.orfonline.org/expert-speak/the-middle-corridor-and-opportunities-for-india

[65] “The Eurasian Transport Network”

[66] “The Eurasian Transport Network”

[67] “Iran Opens Caspian Railway Line to Boost Trade,” Islamic Republic News Agency (IRNA), June 20, 2024, https://en.irna.ir/news/85515033/Iran-opens-Caspian-railway-line-to-boost-trade#:~:text=The%2037%2Dkilometer%20Rasht%20%2D%20Caspian,the%20country’s%20existing%20railway%20network.

[68] Mohammad Salami and Barbara Slavin, “Despite a Recent India-Iran Agreement, Challenges Loom for Chabahar Port,” Stimson Center, https://www.stimson.org/2024/despite-a-recent-india-iran-agreement-challenges-loom-for-chabahar-port/

[69] Mahnaz Abdi, “Iran-China Rail Route a Safe Gateway to Europe for China” Tehran Times, July 21, 2024, https://www.tehrantimes.com/news/501371/Iran-China-rail-route-a-safe-gateway-to-Europe-for-China

Source:

Observer Research Foundation